Australia is facing a crisis of rising expenses and interest rates leading to financial hardship in thousands of households.

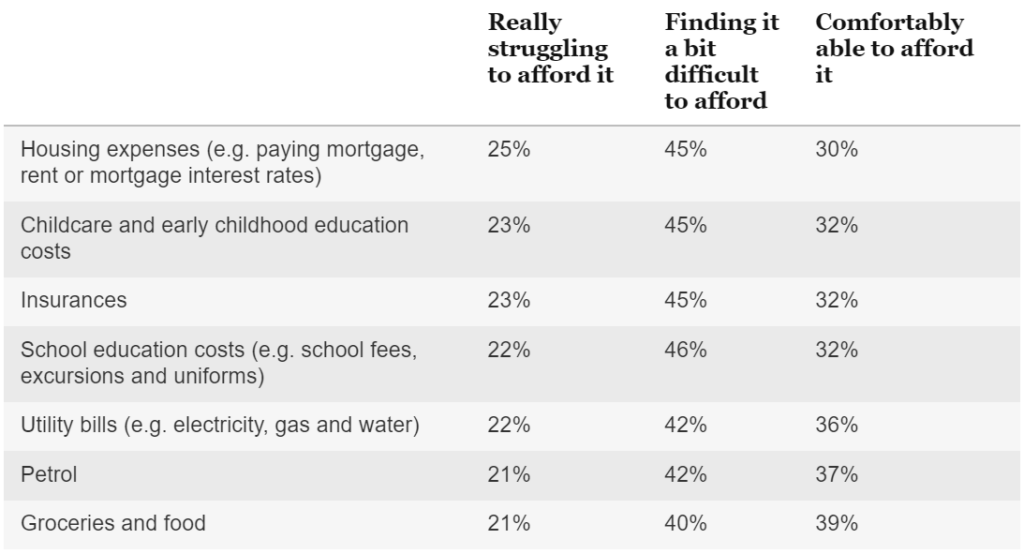

The table below shows how many people are currently struggling to afford their day-to-day expenses – let alone their other debts like personal loans, credit cards or payday loans!

What is the solution?

At Solve My Debt Now, you tell us what you can comfortably afford to pay each week or fortnight towards your debts over a 1–5-year period (this becomes your estimated debt budget).

We then negotiate with your creditors and set up affordable payment plans within that estimated debt budget.

At the same time we work to reduce your debts (40% average debt reduction), fees and interest.

Please give me an example

Say you have $23,000 worth of debt.

And say you told us you could comfortably afford to pay $250 a fortnight towards your debts and were currently in financial hardship trying to pay all your debts.

With that information we would suggest that our 5-year plan might suit because this would fit within your debt budget of $250 a fortnight.

If you agreed to proceed with the 5-year plan at $250 a fortnight you would initially stop paying your creditors and start paying Solve My Debt Now. We would work to negotiate affordable payment plans with each of your creditors and our goal would be that these would fit within your estimated debt budget. At the same time, we would work with your creditors to seek to reduce your debt, freeze your interest and waive any fees. As we start asking you to set up payments to your creditors within your estimated debt budget, your payments to us reduce.

Our goal is that at the end of the 5-year plan (or earlier, depending on if we save you money via our negotiation process, or if you want to pay out your debts sooner because you begin to earn more income), you are debt free.

Alternatively, debts may take decades to pay off if you only pay the minimum monthly amount due – if the debt is a credit card. For example, a $23,000 credit card debt with an 18% interest rate would take 57 years to pay off if you pay the minimum amount (and you would pay $86,125 over that time). Per Moneysmart credit card calculator https://moneysmart.gov.au/credit-cards/credit-card-calculator.

Want to Solve Your Debt? Let us Help – Today.

Book your FREE Consultation now and talk to one of our qualified SMDN Advocates, that will help put you back on the road to financial freedom!